california mileage tax rate

The Division of Workers Compensation DWC is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 4 cents to 625 cents per mile. Personal Vehicle approved businesstravel expense 056.

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Businesses impacted by recent California fires may qualify for extensions tax relief and more.

. Get ready for a costly new Mileage Tax on top of what you already pay at the pump. Rick Pedroncelli The Associated Press. Even though Californias gas tax is among the highest in the country and the rate increased in 2019 it still isnt bringing in.

585 cents per mile driven for business use up 25 cents from. 2021 the internet website of the california department of tax and fee administration is designed developed and maintained to be in compliance with. The state says it needs more money for road repairs.

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. The relocationmoving mileage reimbursement rate for. Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be.

The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022. We Consistently Offer Best In Class Solutions To You Your Clients Tax Problems. California Mileage Tax Rate.

Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. IR-2021-251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an.

Standard mileage rate A more simplified method in which you multiply the business miles and the applicable published federal mileage rate. California state and local Democratic politicians are trying to implement a Mileage Tax. Please visit our State of Emergency Tax Relief page for additional information.

Under California Labor Code 2802 employers are required to reimburse employees for necessary expenses incurred in executing their job duties. In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the. Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents.

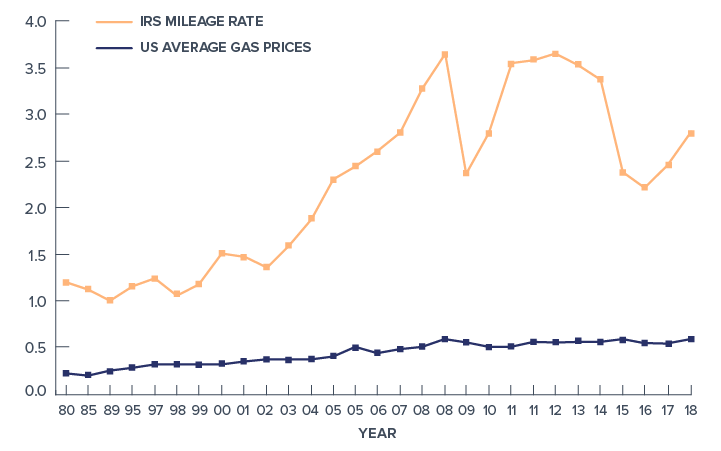

Reimbursement Rate per Mile. The IRS sets standard mileage rates each year. Employers are not required to provide the official rate - they can choose to pay out a lower or higher rate per mile.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile. Personal Vehicle state-approved relocation 016.

California Considers Placing A Mileage Tax On Drivers. 56 cents per mile driven for business use down 15 cents. Heres a breakdown of the.

California Mileage Tax Rate. 15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of. 2021 the internet website of the california department of tax and fee administration is designed developed and maintained to be in compliance with.

Private Aircraft per statute mile. California also pumps out the highest state gas. Wednesday June 22 2022.

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

Your Guide To California Mileage Reimbursement Laws 2020

Is Buying A Car Tax Deductible Lendingtree

As Electric Vehicles Shrink Gas Tax Revenue More States May Tax Mileage Missouri Independent

How To Claim The Standard Mileage Deduction Get It Back

Irs Announces 2021 Mileage Rates Church Law Tax

Mileage Reimbursement A Complete Guide Travelperk

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Thoughts At A Workshop On Replacing Ca S Gas Tax With A Mileage Fee Streetsblog Los Angeles

What S Easier Killing Aliens Or Levying A Vehicle Mileage Tax Tax Policy Center

Privately Owned Vehicle Pov Mileage Reimbursement Rates Gsa

Everything You Need To Know About Mileage Reimbursements

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates

La Mesa S Fight Over Climate Change Has Global Reach Time

Irs Raises Standard Mileage Rate For Final Half Of 2022

Infrastructure Plan Biden Rejects Gas Tax Mileage Fee To Pay For It